In this era of rapid technological advancements, the way we handle financial transactions has transformed significantly. With current payment trends, gone are the days of relying solely on traditional payment methods such as cash or checks. The digital revolution has ushered in a new era of payment trends that are revolutionizing the way we make purchases, transfer funds, and conduct business transactions. In this blog, we will explore some of the current payment trends that are shaping the financial landscape.

Mobile Payments

One of the most significant payment trends of recent years is the rise of mobile payments. With the uniqueness of smartphones and the convenience they offer, consumers are increasingly turning to mobile payment apps to make purchases. Services like Apple Pay, Google Pay, and Samsung Pay allow users to link their credit or debit cards to their smartphones and make payments by simply tapping their device at a contactless payment terminal. The added layers of security and ease of use have made mobile payments a preferred choice for many consumers worldwide.

Contactless Payments

Contactless payments have gained immense popularity, especially during the global pandemic. By leveraging near-field communication (NFC) technology, contactless payment methods such as credit and debit cards, mobile wallets, and wearable devices enable users to make transactions by simply tapping or waving their card or device near a contactless-enabled terminal. This quick and secure method eliminates the need for physical contact and provides a seamless payment experience for both customers and businesses.

Peer-to-Peer (P2P) Payments

P2P payments have revolutionized the way we transfer money to friends, family, or acquaintances. Services like PayPal, Zelle, and Cash App allow users to send and receive money effortlessly through their mobile devices. These platforms offer convenience and speed, eliminating the need for cash or checks. P2P payments have become popular for splitting bills, reimbursing friends, and even making small business transactions.

Cryptocurrency and Blockchain

In this era of rapid technological advancements, the way we handle financial transactions has transformed significantly. With current payment trends, gone are the days of relying solely on traditional payment methods such as cash or checks. The digital revolution has ushered in a new era of payment trends that are revolutionizing the way we make purchases, transfer funds, and conduct business transactions. In this blog, we will explore some of the current payment trends that are shaping the financial landscape.

One of the most significant payment trends of recent years is the rise of mobile payments. With the ubiquity of smartphones and the convenience they offer, consumers are increasingly turning to mobile payment apps to make purchases. Services like Apple Pay, Google Pay, and Samsung Pay allow users to link their credit or debit cards to their smartphones and make payments by simply tapping their device at a contactless payment terminal. The added layers of security and ease of use have made mobile payments a preferred choice for many consumers worldwide

Biometric Authentication

Security remains a paramount concern in the payment industry. Biometric authentication, such as fingerprint recognition and facial recognition, has gained traction as a secure and convenient method to verify transactions. Many smartphones and payment apps now incorporate biometric features to authenticate users, adding an extra layer of security while streamlining the payment process.

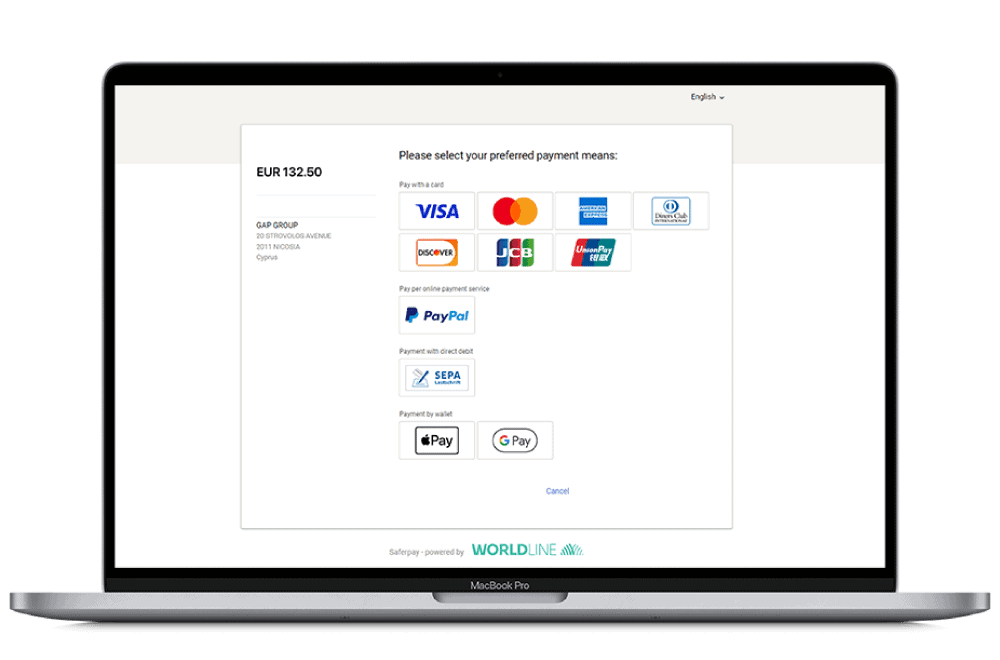

In-app and Online Payments

The growth of e-commerce has led to the rise of in-app and online payments. Consumers can now make purchases directly within apps or websites, streamlining the checkout process. E-commerce platforms and businesses are integrating secure payment gateways and digital wallets to enhance customer convenience and reduce friction during online transactions.

Conclusion

As technology continues to advance, payment trends are evolving at a rapid pace. Mobile payments, contactless payments, P2P transfers, cryptocurrencies, biometric authentication, and in-app and online payments have revolutionized the way we handle financial transactions. These trends offer enhanced convenience, speed, security, and efficiency, creating a seamless payment experience for consumers and businesses alike. Embracing these new payment methods can unlock numerous benefits and open doors to a more connected and digitized financial future.

Get in touch

One of the strongest pillars of Vpayments is building meaningful and long-term relationships with our customers. These relationships occur through honest and transparent communication.

Contact us by email, or phone and organize a meeting with our team so that we can discuss anything you need.